Data is everywhere. Everybody wants data. More data. Data-driven is the thing to be. And when we ask for more data, we get more data – lots of it. Data is highly valuable. Some even call it the new oil. But it’s easy to get lost in the data forest. If you had a hard time getting value out of your data, maybe it’s because you had the wrong kind of data? Because the most valuable of all forms of data is behavioural data – the new rocket fuel for your organisation.

“Getting to know your customer” and acquiring actionable customer insights is the holy grail of 21st-century marketing. This is a no-brainer. And still, many organisations are struggling to make sense of their customer data and extracting the value embedded in it.

I would argue that’s because they have the wrong kind of data about their customers. The customer data that is highly valuable and highly actionable is behavioural data. In this blog post, I will examine what behavioural data is, how you can gather it, and how you turn it into highly potent rocket fuel.

But first, let’s go back in time.

Before the arrival of the Internet and direct-to-consumer sales, the whole process of gathering customer insights was very complex and lengthy and had a multitude of possibilities for disconnection and errors.

A product manager would come up with a new idea. He or she would make some market research. Decide to develop and launch the product. Distribute the product to resellers, and inform them about the upcoming product launch. Create a marketing campaign. Start seeing sales coming in (often with a delay of several months because that’s the time it took to get sales data back from retailers). Finally, at the end of this lengthy process, possibly getting some customer feedback about the user satisfaction of the product.

In this process, it was impossible for the brand owners and product managers to directly observe how consumers reacted to the product and how they used it. So, they decided to go for the second-best: talking to the customer directly. Et voilá – focus groups and in-depth customer interviews.

Because we were unable to observe actual behavioural we decided to go for the second best – asking consumers what they thought their behaviour was.

The type of customer data generated by these focus groups and interviews is “attitudinal data”. It mostly reflects on the attitude of consumers versus your brand and products in relation to the products of competing brands.

These are typical questions that you would find in such an interview. As you can see, they mostly describe the person’s attitude towards your brand. It is about how they feel about it.

These insights can be highly valuable. If you find out that the message you want to convey and what you want customers to feel about your brand and products is not what is happening in reality – then you have a strong case for a brand repositioning project.

I think the best example I know here is how Volvo was able to go from a family car brand focused on safety, to a premium lifestyle brand, by using mega-cool celebrities in their marketing. – “Hey, if Zlatan can drive a Volvo and be cool, why shouldn’t you be able to?!”

Changing brand attitudes is the objective of brand marketing. And when good brand marketing does this well, it is extremely valuable.

BUT.

When we travel further down in the customer journey to the point where consumers are making decisions in your Facebook campaigns, on your landing page, in your email marketing flows – this type of data becomes less valuable.

It is very difficult to predict what action a customer will or will not take based on their attitude or feeling versus your brand in general.

Or in a more scientific lingo: The predictive power of attitudinal data in determining behaviour is low.

At the beginning of new technology, we often don’t use it to create radical new innovations, but instead, we use it to create the next version of things we already have. This is incremental innovation as opposed to disruptive innovation.

At the beginning of the Internet era, we were still not able to directly observe user behaviour on our digital platforms, so we went for the second best again – we asked them.

You have probably seen or even participated in one of these web surveys:

There are two problems with this research approach:

Most likely, you have heard about the lighting experiments that were carried out in at Hawthorne works in Cicero, Illinois between 1924-1927. In short: They found that the productivity in the factory rose – and not because of the specific changes that were made in the work environment, but just because of the fact that they made some changes at all and were observing the factory workers – The Hawthorne effect.

The second factor that skews the results of web surveys has to do with our irrational, fast and emotional behaviour, particularly in an online environment. Nobel Prize winner Daniel Kahneman and his colleague Amos Tversky discovered a pattern in our decision-making process, usually referred to as System 1 – System 2 thinking.

In short; the System 1 part of our brain makes most of the decisions in our daily life. It trudges along on a kind of autopilot, making not the most perfect decisions, but good enough decisions, that don’t involve too much thinking.

The problem is that when we answer questions in a survey, we invoke the system 2 part of the brain, which was not even involved in making the decision. And this part of the brain only speaks a language which I call “Rationalese”. So, it now scrambles to find rational explanations for our behaviour.

To be blunt: People have no idea what they’re doing online.

We make emotional decisions which we later try to find rational explanations for.

If attitudinal data doesn’t do the job for us, let’s try demographical data. This type of data describes how old a person is, if it’s a man or a woman, where they live, how much money they make, what magazines they read, what hobbies they have and so on.

The keeper and promoter of this kind of data is called: The media agency.

Often the message in a marketing campaign is preceded by a media plan. We tell the media agency that we want to reach urban women between 30-50, with a disposable income of this and that and so on. They do their magic and tell us we should be spending 30% of our budget on social media, 20% on outdoor in metro areas, 15% on TV4 and so on.

So demographical data is really good when you want to figure out where and how are you should spend your media budget. But that’s where it ends. Often this data gets packaged into so-called personas. But if the persona description is mostly demographical, it won’t do you much good except for buying media. Or as my good friend Bryan Eisenberg puts it:

At this point you might be saying to yourself:

– “Well this makes sense, but where is the proof and how do I apply it?”

Glad you asked – let me show you with this case from a project with Skandia.

We had been given the task to develop a landing page for a savings advisory service.

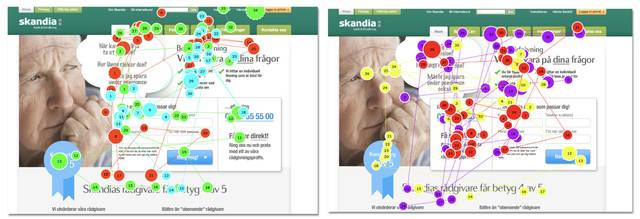

As input to our work, we were given a description of the target audience, almost exclusively built on demographical data. In the design process, we came to a point where we needed to make a decision between two design variations. We wanted to be data-driven, so we dug into the dataset that had been given to us. But we soon discovered that this demographical data was useless in terms of making a design decision. So instead, we made some quick user tests with our eye-tracking equipment.

So we swapped the process of:

-“Arguing over useless demographic data in a long meeting involving several highly paid persons”

to

– “Quickly developing a test scenario, putting it in front of real people, capturing their behavioural data, generating valuable insights in just a few hours and involving only one highly paid person from our side.

Companies should do this more often because it’s so powerful.

I started Conversionista because I wanted to be the number one conversion optimisation company in Scandinavia. Conversion optimisation, or CRO, sounds very narrow and limited by definition, but it is really about increasing the number of successful outcomes on your digital platforms.

That outcome can be a purchase, or a newsletter signup, or a whitepaper download. Whatever it is – we want to make it happen more often. Now, all of those things I just described are behaviours. So if you want a behaviour to occur more often you’re in the business of behaviour change. And you couldn’t possibly expect to steer or nudge or influence behaviour if you don’t understand the current behaviour of your customers. Hence, behaviour data is imperative.

If you want to change behaviours you need to focus on behavioural data.

The complete process then becomes:

Easy, no?!

If you miss any of those four steps in your process, you decrease the likelihood of success dramatically. No shortcuts, please!

There are actually many sources of behavioural data. The most common one being your web analytics tools such as Google Analytics or Adobe Analytics. But beware – the highly valuable behavioural data can still be hidden behind standard reports and vanity metrics. Vanity metrics are top-level metrics, such as the overall number of visitors, that look good if they increase, but you actually have a very little chance of influencing them.

The best way to get the right behaviour data is to work your way backwards. First, you need to try and figure out – “What is the behaviour I want to influence – Is it a particular scrolling behaviour, is it a click on a button, or is it the start of engaging with an online form?”

Secondly, you need to figure out if you are currently capturing all the details of that experience or behaviour? Most likely, you are not. Even if you have Google Analytics installed, you should know that GA does not track any of your important events on critical pages unless you specifically add trackers to those events.

In many cases when we go to clients and ask those questions, we get the uncomfortable answers –“don’t know”, “I need to check that”, “not sure……”.

And web analytics tools have limitations. You can see clicks on clickable items on a page but it’s hard to see in what order they happen and it’s impossible to see if people are trying to click things that are not clickable. In the web analytics tool, you can see whether users reach a certain scroll depth, but you can’t see the scrolling behaviour in its detail: how fast it happens, if they go back up, come back down again, and so on.

That’s when you need an interaction analytics tool, such as Hotjar or Fullstory. They will give you most of this behavioural data.

The final step of user insights and behavioural data is user testing and eye-tracking. When you do interaction analytics you see everything that happens on the screen but there are two additional things that user testing and eye tracking will be able to uncover:

These analytics tools and methods will give you tons of insights but you need to close the loop yourself – answering the question WHY these behaviours happen, and how can we change them to our advantage? My best recommendation is to read up on a lot of books and blogs on consumer behaviour and behavioural economics. My top ones being:

Robert Cialdini: Pre-suasion

Dan Ariely: Predictably Irrational

Nick Kolenda: Methods of Persuasion

If you are observant, you probably noticed that we draw a conclusion from a data set of 10 observations in the Skandia case. We had created a qualitative data set, and then we drew quantitative conclusions from it – not good. If you want to learn more about how you can work with qualitative and quantitative data in unison.

In any case – we believe that it is better to base your decisions on a small data set (if that’s all you have) than making decisions based on NO data.

So this is the double-edged sword of data. You have to be strict and try to work hard to ensure data quality and statistical robustness, but at the same time, you must accept that there are limitations and you need to make decisions on imperfect data. This is not an either-or-thing. You have to be able to do both.

But most importantly – refocus your organisation around the most valuable of data types – behavioural data. And watch your new rocket fuel make your business go intergalactic.